AUSTRALIA’S beef exports during April continued to surge, despite the impact of holiday-shortened working weeks and weather disruptions to processing during the month.

With only 20 working days for the month due to Easter and ANZAC Day breaks, beef exports to all markets still hit 105,367 tonnes, only marginally behind March, and a massive 33,000t or 46 percent higher than April last year.

Last month recorded the highest in-month figure for April exports since Australia’s extraordinary 2015 drought year, when volumes hit 113,431t due to high cattle turnoff.

For the first four months of the 2024 trading year, Australia’s export tonnage has already hit 381,359t, almost 89,000t or 30pc up on the same four months last year, as weekly processing numbers continue to rise heading into winter.

Most major export markets were sharply higher, year-on-year, with the United States again leading in volume, as it has each month since September.

Despite shipping infrastructure challenges, exports to US East and West Coast ports last month reached 27,257t, up another 3pc from an already strong March number of 26,484t. Last month was the biggest volume seen since December’s extraordinary finish to the year when in-month volume hit 35,782t.

Despite shipping infrastructure challenges, exports to US East and West Coast ports last month reached 27,257t, up another 3pc from an already strong March number of 26,484t. Last month was the biggest volume seen since December’s extraordinary finish to the year when in-month volume hit 35,782t.

Frozen (mostly trimmings for hamburger beef) volume to the US last month reached 79,234t or 75pc of the total, as the US continues to bid frozen trimmings product away from other Australian export customers.

For the first four months of this year’s trade, US volume has reached 95,390t, up around 45,000t or 81pc on the same period last year.

Japan last month took 21,731t of Australian beef – marking a strong start to the year and up more than 6500t or 30pc on April last year.

Calendar year to date volume has reached 82,864t, up more than 18,500t or 29pc, as volumes of export beef out of the US to Japan start to decline.

Third largest market last month was South Korea, taking 15,785t, up 6pc on the previous month and 16pc higher than April last year. Four-month trade for 2024 has reached 56,281t, much the same as last year, as the country continues to eat its way through its own domestic Hanwoo beef herd under a government policy designed to curb inflation.

The flatness of the China imported beef market due to economic difficulties was evident in trade volumes seen last month, and for the first four months of the year.

China ranked fourth again last month among Australia’s export customers taking 14,888t, down 10pc from March, and 11pc behind April last year. The first four months of this year have produced a total of 61,229t, down 2pc on last year.

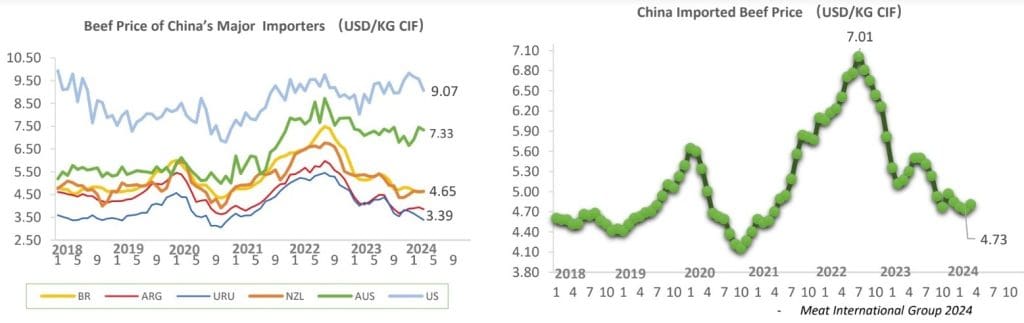

As this graph shows, Australian average beef prices in China (measured in US$ terms) have been less impacted than all other export suppliers to the country, bar the United States. Other countries including Brazil, New Zealand, Argentina and Uruguay have suffered much large price falls, since the peaks of 2022.

Among emerging and second-tier markets, trade to Indonesia has started to normalise after being impacted earlier this year by Import Permit disruptions to both live cattle and beef.

Last month’s tally was 7958t – still high, by historical standards, but way behind the unusual record number of 10,255t recorded a month earlier, when the import permit issue was having a big bearing on the market.

This time lasty year, April exports to Indo (seen after Ramadan) were 4066t.

For the year to date, beef exports to Indo remain unusually high, at 21,385t, some 9pc higher than the year previous.

In other parts of the world, the EU and the United Kingdom remain basket-cases for Australian beef – despite the sighing of the UK Free Trade Agreement a year ago.

Last month, export volumes reached 1285t and 417t, respectively, while for the year to date, tonnage has reached 4154t and 1536t.

The Middle East region of seven countries remains a mostly price-sensitive market, taking 3613t of Australian beef last month and 11,700t for the year to date, as trade becomes dominated by cheaper Brazilian supply.

A little-recognised export market worth watching is Canada, which has imported unusually large volumes of Australian beef this year, having (like its neighbour the US) suffered its own drought. Volume last month was 2371t, on top of almost 2800t the month before, and about five times the volumes seen this time last year.

For the first four months of 2024, volume to Canada has reached 8917t, ranking Canada seventh among our export customers presently, just behind Taiwan (8989t in April).

Compare than with January-April trade last year, when volume to Canada reached only 2820t – showing this year’s consignments around three times as high.